|

|

The number of household’s categorised under the heading “At Risk of Poverty Rate,” rose to 15.8% in 2010, up on the 2009 figure of 14.1%. Latest published figures also show, in 2010, that another 6.2% were listed as “Consistent Poverty Rate,” again an increase of 0.7% on 2009. The number of household’s categorised under the heading “At Risk of Poverty Rate,” rose to 15.8% in 2010, up on the 2009 figure of 14.1%. Latest published figures also show, in 2010, that another 6.2% were listed as “Consistent Poverty Rate,” again an increase of 0.7% on 2009.

Figures from the Central Statistics Office (CSO) reveal that the gap between rich and poor grew over 2009/10, while the average income of high earners was 5.5 times that of those in the lowest income group and 1.2 times higher than a year earlier.

A survey on income and living conditions in Ireland found that the threshold for identifying those at risk of poverty fell by more than 10 per cent – from €12,064 in 2009 to €10,831 in 2010.

The CSO said children remained the most exposed age group living consistent poverty, a rate of 8.1 per cent.

Meanwhile the Government has admitted, following a parliamentary question from former Labour TD Tommy Broughan, that Social Welfare applicants are waiting for up to 84 weeks to have appeals heard. The Department of Social Protection have confirmed that between 2009 and 2011, the number of social welfare appeals had increased dramatically from 15,000 a year to 32,000. The average summary appeal period rose from 18.2 weeks in 2009 to 25.1 weeks in 2011 and if an oral hearing is required, the average waiting time has risen from 34.8 weeks in 2009 to 52.5 weeks (Over a year) during the same period.

These statistics further highlight the unfairness of Minister Phil Hogan’s Household Charge, which in four days time will force people to break the law, because of their present financial standing.

Is This Government Forcing Law Abiding Citizens To Break The Law?

I am no lawyer, but surely, in jurisprudence, duress or coercion refers to a situation whereby a person performs an act as a result of threat or other pressure against the person. Call it a law protecting, those who are being coerced, because of their personal financial circumstances, to break the law, because they cannot afford to pay the Household Charge.

Black’s Law Dictionary (6th ed.) defines “Duress,” as any unlawful threat or coercion, used to induce another to act in a manner that otherwise they would not. Surely a person can raise an “Economic Duress defence,” when force or the law, compels him to enter into a contract which he cannot afford. Is the defendant therefore being forced to break the law by another party, in this case our government, which caused the financial distress and for which the defendant is being now asked/coerced into paying?

I repeat, I am not a qualified legal person, so is there any qualified legal opinion out there, willing to comment?

Once upon a time there were three little pigs that left home to seek their fortunes. Before they left, their mother told them “Whatever you do, do it the best that you can, because that’s the way to get along in this world.” Once upon a time there were three little pigs that left home to seek their fortunes. Before they left, their mother told them “Whatever you do, do it the best that you can, because that’s the way to get along in this world.”

The first little pig built his house out of straw because it was the easiest & warmest. The second little pig built his house out of sticks. This was stronger than a straw house. The third little pig built his house out of bricks.

Then one night the big bad greedy wolf, who loved to eat fat little piggy’s, came along and saw the first little pig in his house of straw. He said “Let me in, Let me in, little pig or I’ll huff and I’ll puff and I’ll blow your house in!”

Ok, the rest is storybook history, known to all.

Recently a real live greedy little wolf, named Phil Hogan announced that he was going to blow our houses down. Well not blow down exactly, it was worse than that, he intends to place a tax on our buildings, and charge a tax on a basic human God given right, namely our water supply, which he and others before him have continuously poisoned for years.

This little Fine Gael Wolf, on being refused by the ‘great unwashed,’ has begun imitating Fianna Fail tones reminiscent of the late Charley Haughey:-

- If we do not pay he will access our bank accounts and remove €100 plus interest.

- He will force employers to deduct it from our wages, pensions and Social Welfare payments. (Would this breach the Croke Park agreement?)

- His latest Nazi bullyboy tactic; he has instructed Councils to send out teams of officials to knock on doors to threaten and intimidate us. (Obviously German IMF officials, over coffee, told him their version of Kristallnacht, the Night of Broken Glass, carried out by SA storm troopers and civilians.) By next weekend do not be surprised if offenders, who fail to comply with his demands, are instructed to wear house shaped badges, sewn unto their outer garments; The Red house shape for non compliant politicians, liberals, communists, trade unionists, social democrats, socialists, Freemasons, and anarchists. The Green house shape for non compliant professional criminals. Blue for emigrants. Pink for sexual offenders, homosexual men, zoophiles and paedophiles. Purple for Jehovah’s Witnesses. Black for the work shy, the members of the travelling community, the mentally ill, prostitutes, lesbians, drug dealers, beggars and alcoholics. Yes Nazi Germany & Phil would sort out this country, given half a chance.

When his storm troopers come calling soon, how are you going to defend your actions? My advice is reply using the words, of Minister Phil Hogan himself, when he was asked in 2009 to take a 10% pay cut on his estimated €200,000 salary & expences. Quote: “My personal circumstances don’t allow that at the moment.” Of course if you can’t remember these words, quote the words of the three little pigs, “Not by the hair of my chinny chin chin.”

I refer to my previous rant of March 21st last. Please also see Here and view Here. I also draw your attention to Here and to the correct comment made by one of our readers, Rona, just yesterday. Indeed to fully understand that of which I rant, it is essential that you the business person, you the unemployed and you the student, latter possibly depending on Summer casual work to afford next year’s school fees, read all three links. I refer to my previous rant of March 21st last. Please also see Here and view Here. I also draw your attention to Here and to the correct comment made by one of our readers, Rona, just yesterday. Indeed to fully understand that of which I rant, it is essential that you the business person, you the unemployed and you the student, latter possibly depending on Summer casual work to afford next year’s school fees, read all three links.

Next Visit Here, North Tipperary Arts Website, another site financially supported by North Tipp Co.Co.

Let us pick just two categories.

Go to Theatre & Performance on this site. Is The Source Theatre in Thurles advertised?

Go to Galleries & Museums on this site. Is the GAA Museum or Thurles Famine Museum in Thurles represented? Is Thurles LIT a museum? How much use and what is the cost of funding this useless website?

I believe it is fair to say that Thurles town, situated in North Tipperary, is hardly recognised on this site, yet Minister Phil Hogan wants us to fund North Tipperary Co Council & Thurles Town Council, who sit idle as the Nenagh area hogs the limelight.

Why Is Thurles Not Marketed?

Do not ask me; ask your local elected representatives. In relation to St Mary’s Famine Museum, all information was forwarded for inclusion on this site, both Text & Pictures.

However a clue to this marketing failure may possibly be found here, in the Thurles and Environs Development Plan 2009-2015 drawn up by North Tipp County Council and I quote:

“The potential of the tourism industry in Thurles Town and environs is largely undeveloped. There does, however, exist:

- Poor understanding of the towns inherent historic characterises;

- Inadequate protection of the historic environment;

- Lack of development of commercial activities associated with the heritage industry, such as hotels, leisure activities, organised trails, etc;

- Environment problems such as traffic congestion, pollution and poor quality building stock.

An attractive town centre goes hand in hand with a strong tourism base.

It would appear our Local, County and Government elected representatives of all political party’s haven’t read this yet.

Continue reading Where Is Thurles Co Tipperary Marketed

Irish Simplified Tax Return For 2012 One of our more regular discerning daily readers, sent me a short poem today, which I now share with you.

I regret I do not know the author’s name, so I can’t give due credit, but thank you.

The Politicians National Anthem

Tax his land, Tax his bed, Tax the table at which he’s fed.

Tax his work, Tax his pay, (he works for peanuts anyway!)

Tax his cow, Tax his goat, Tax his pants, Tax his coat.

Tax his tobacco, Tax his drink, Tax him if he tries to think.

Tax his car, Tax his gas, then find other ways to tax his ass.

Tax all he has, and let him know, that you won’t be done till he has no dough.

If he screams and hollers, then tax him more, Tax him till he’s good and sore.

Then tax his coffin, Tax his grave, Tax the sod in which he’s laid.

When he’s gone, do not relax, it’s time to apply Inheritance Tax.

Airline Luggage Tax, Airline Fuel Tax, Airport Maintenance Tax, Building Permit Tax, Parking Tax, Cigarette Tax, Chewing Gum Tax, Dog Tax, Television Tax, Electrical Goods Disposal Tax, Corporation Tax, Goods and Services Tax , Death Tax, Driving Permit Tax, Environmental Tax, Excise Tax, Income Tax, Fishing Tax, Gun Tax, Food Tax, Car Test Tax (NCT), Petrol Tax, Health Tax, Inheritance Tax, Interest Tax, Heating oil Tax, Lighting Tax, Liquor Tax, Luxury Tax, Marriage License Tax, Medical Care Tax, Mortgage Tax, Pension Tax, Property Tax, Poverty Tax, Prescription Drug Tax, Real Estate Tax, Car Tax, Vehicle License Registration Tax, Retail Sales Tax, Service Charge Tax, School Tax, Telephone Tax, Vehicle Sales Tax, Water Tax, Workers Compensation Tax, Carbon Tax, Universal Social Tax, Household Tax and finally VAT which is “Tax on Tax.”

Very few of these taxes existed 100 years ago. We had absolutely no national debt, had a large middle class society, a huge manufacturing base, jobs and mothers stayed home to raise a family of which everyone was proud.

So what in the Hell happened? Could it have been caused by overpaid, lying, parasitic politicians, wasting our hard earned money?

Why not give us your views, comment please?

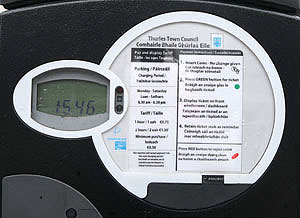

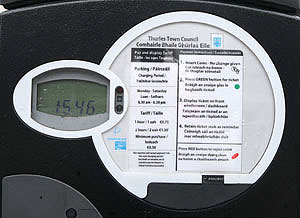

County Councils are coming under intense pressure to remove costly parking fees. Some Local Authorities are losing millions of euro each year on their car parking charges, with one-in-three paying out more in costs, than they actually collect. County Councils are coming under intense pressure to remove costly parking fees. Some Local Authorities are losing millions of euro each year on their car parking charges, with one-in-three paying out more in costs, than they actually collect.

Parking Fees are also costing millions in lost consumer spending to businesses in local town centres, like Thurles, because we have permitted our Town Councils to emulated big cities parking restrictions by introducing on-street parking charges.

Motorists in Ireland paid in excess of €100m last year in parking charges and fines, however despite this massive gravy train, 18 county and town councils still managed to lose money, mainly through the employment of traffic wardens, the maintaining of ‘Pay and Display‘ machines, and the actual costs of collecting the ‘gravy,’ from the machines.

Enforcing traffic by-laws is costing well in excess of the revenue generated in many areas and when added to the loss in consumer spending by businesses, both North and South Tipperary County Councils must now come under pressure to scrap parking fees all together.

You won’t be supprised to learn that both Tipperary Councils have reported huge losses in the running of their car parking services, with South Tipperary recording a loss in excess of €20,000, while our own beloved North Tipperary Council losses are said to be in the region of a whopping €43,000, latter a shortfall which will inevitably be paid by business who themselves have already suffered loss, when their customers took the decision to move out of town centres, in favour of large Supermarkets providing free parking, on the outskirts of towns like Thurles.

Add this high cost to time wasted by local councillors discussing dog pooh and litter problems, most of which is dropped when Traffic Wardens are off duty, maybe now is the time for discussions on fiscal rectitude.

Local Councils have opted not to increase parking charges here in Thurles for this year and it is now believed that if pressure is applied, they may scrap these charges altogether.

Remember here in Thurles to post a standard letter and obey the law costs a minimum of €1.05 including the stamp.

|

Support Us Help keep Thurles.info online by donating below. Thank you.

Total Donated 2026: €40.00

Thank You!

Daily Thurles Mass Livestream

|

The number of household’s categorised under the heading “At Risk of Poverty Rate,” rose to 15.8% in 2010, up on the 2009 figure of 14.1%. Latest published figures also show, in 2010, that another 6.2% were listed as “Consistent Poverty Rate,” again an increase of 0.7% on 2009.

The number of household’s categorised under the heading “At Risk of Poverty Rate,” rose to 15.8% in 2010, up on the 2009 figure of 14.1%. Latest published figures also show, in 2010, that another 6.2% were listed as “Consistent Poverty Rate,” again an increase of 0.7% on 2009.

Recent Comments